If you want to know what types of bad things we avoided by supercharging the labor market recovery, I suggest you start with this 2020 review by @TillvonWachter@twitter.com on entering job markets with high unemployment.

Graduating cohorts (w/o) college degree usually lose around 10-15 percent in earnings at entry for "normal" downturns, and much higher for "severe" ones.

And it takes 10 to 15 years for earnings to recover.

Big scarring effects.

2/

And even after 15 years, the scars don't go away.

Earnings may recover, but then these unlucky cohorts start developing greater incidence of heart, lung, and liver disease, followed by greater mortality.

3/

Why does this happen? Initially the cause is joblessness, but persistence comes from job quality.

High wage firms less likely to hire during downturns: pushes new entrant to crappier employers who survive & thrive in a low-competition environment.

https://pubs.aeaweb.org/doi/pdfplus/10.1257/mac.20150245

4/

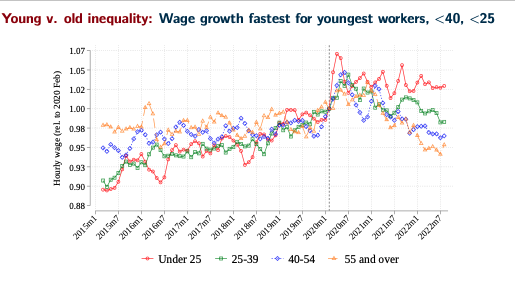

What's amazing is how the current environment looks diametrically opposite to all this.

Today young non-college workers have the fastest wage growth, driven by rapid job changing in a vigorous job ladder which collapsed following the Great Recession.

https://bcf.princeton.edu/wp-content/uploads/2022/10/Combined-Slides.pdf

5/

It makes a big difference in peoples lives how quickly we heal the labor market using fiscal/monetary policy, and how much we help create high-paying jobs.

The cost of not doing that is high both for the pocketbook, but also for our health, bodies, and life expectancy.

6/6

I was on the academic job market in 2009, one or the worst markets in many generations.

This is why I am economically adjacent to millennials much more so than you would think based on my age (Gen X)

@arindube Surprising that there is no more acknowledgement of this. This recovery was the fastest on record from the aggregate point of view. And we are now seeing the benefits of returning faster to low unemployment rates. Those are visible in the aggregate and also for the more disadvantaged groups that tend to recover slower than others in a typical (slow) recovery.

@antoniofatas I completely agree. We can argue about whether inflation overshot due to policy or other factors, etc. But the *avoided hysteresis* is a story that is not enough discussed.

@arindube we welcome you with open arms